are campaign contributions tax deductible in 2019

While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns and to support political candidates. Honolulu Mayors Budget Proposal Includes No Tax Rate Or Fee Hikes.

Theatre Bristol Annual Appeal Campaign Theatre Bristol

The Virginia Public Access Project is a 501c3 tax-exempt corporation.

. On March 22 2019 the Offshore Private Banking Campaign was announced. However starting in 2019 for the 2018 tax year the IRS raised the limit on charitable contributions of cash from 50 to 60 of a taxpayers Adjusted Gross Income according to page 8 of IRS Publication 5307. Updated January 19 2022.

Arts and culture draw us together and help tell us who we are. The trio of defendants used their family members to make illegal campaign contributions. The money in these accounts grows tax.

The traditional 401k 403b or 457b are the most common types of employer-sponsored savings plansThese are defined contribution plans mostly funded by the employee with some lucky people also receiving matching employer contributions. A 501c3 organization is a United States corporation trust unincorporated association or other type of organization exempt from federal income tax under section 501c3 of Title 26 of the United States CodeIt is one of the 29 types of 501c nonprofit organizations in the US. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Americas 1 tax preparation provider. Although a political donation is non-deductible according to the IRS it is still wise to keep a. See Tips for taxpayers who need to file an amended tax return and go to IRSgovForm1040X for information and updates.

This amounts to 58000. The annual cap on deductible contributions to health savings accounts HSAs rose in 2022 from 3600 to 3650 for self-only coverage and from 7200 to 7300 for family coverage. Features of an HSA include.

Self-Employed defined as a return with a Schedule CC-EZ tax form. This means that clients can make deductible charitable contributions to a broader set of organizations than they would be allowed to on a personal return. We know that the spirit of innovation requires more than just tax cuts.

Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done pre-tax. Sussmann has been charged with making a false statement to a federal agent. Federal election law appears to provide a way to pay that old debt that Rubio has yet to use.

You can also see whether your companys 401k allows you to make after-tax contributions to your 401k up to the legal limit of combined employeremployee contributions. Enter the nature of the tax the taxing authority the total tax and the amount of the tax that is not deductible for California purposes on Form 100 Side 4 Schedule A. Amended returns for all prior years must be mailed.

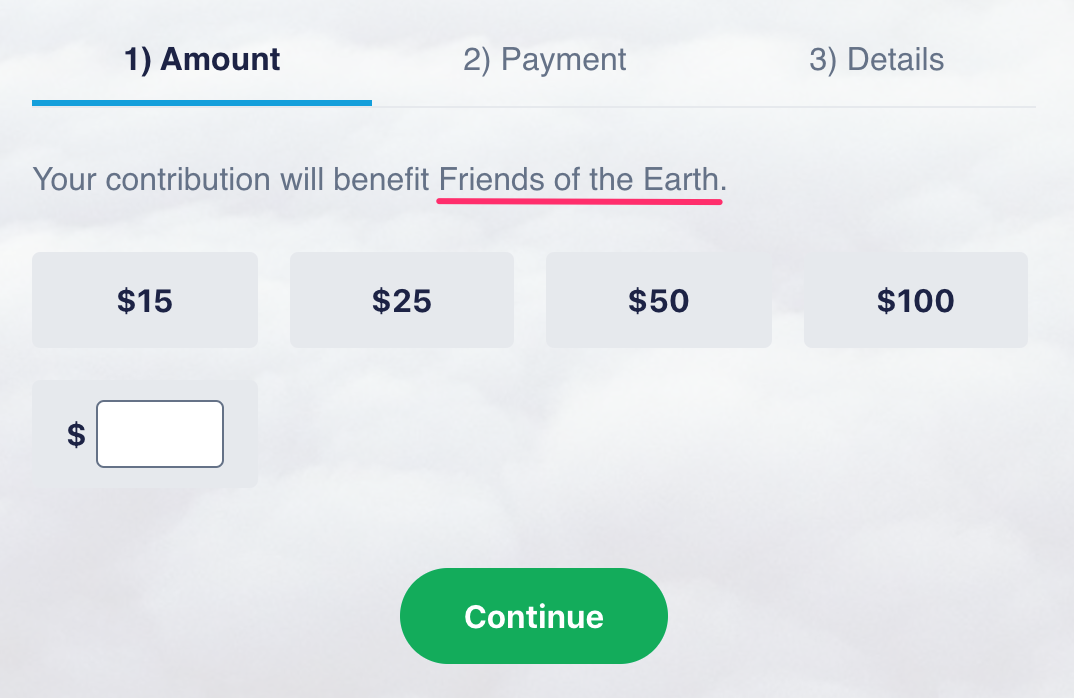

In addition trusts and estates may make a special election under Regs. 2019 The Virginia Public Access Project. A political campaign donation receipt is written documentation provided to a donor for a contribution made to a political organization.

Funds can legally be transferred between a candidates previous federal campaign committee and his current campaign committee as long the funds being transferred dont include any illegal contributions. A carbon tax is a tax levied on the carbon emissions required to produce goods and services. Treatment streams under this campaign will also address individual FATCA compliance.

In this way they are designed to reduce carbon dioxide CO 2 emissions by increasing prices of the fossil fuels. To do so you must have e-filed your original 2019 return. If the corporation is using the California computation method to compute the net income enter the difference of column c and column d on Schedule F line 17.

While tax deductible CFC deductions are not pre-tax. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Your own HSA contributions are taxdeductible or pretax if made by payroll deduction.

Carbon taxes are intended to make visible the hidden social costs of carbon emissions which are otherwise felt only in indirect ways like more severe weather events. Contributions to traditional IRA and 401k accounts are made with pretax dollars which can significantly reduce the workers income tax burden for the year. This allows for flexible tax planning.

Your Window into Virginia Politics Find your legislators where to vote. You can now file Form 1040-X electronically with tax filing software to amend 2019 Forms 1040 and 1040-SR. For years the IRS had limited tax deductions for charitable contributions to up to 50 of a taxpayers Adjusted Gross Income AGI.

1642c-1 b to treat contributions as paid in the preceding tax year. The funds in your HSA can be used to pay for your cost share for your deductible or other qualified medical expenses. Tax-Advantaged Retirement Savings Accounts Tax-Deferred Plans.

Interest earned on your account is taxfree. VPAP is supported entirely by tax-deductible contributions. It requires a belief in science ambitious partnerships between government academia and the private sector and a plan to invest in the freshest most innovative ideas out there.

1 online tax filing solution for self-employed. Donors can contribute to a political organization by donating money or goodsservices in-kind donation. From Sharyl Attkisson.

Donors who are eligible to itemize charitable contributions on income tax returns may include contributions made through the CFC. 501c3 tax-exemptions apply to entities that are organized and operated exclusively for religious. Judicial Watch has filed a Freedom of Information Act FOIA lawsuit against the Central Intelligence Agency CIA requesting records of meetings and phone conversations between any CIA personnel and former Clinton campaign lawyer Michael Sussmann.

If you are one of those citizens and you were hoping for a tax break unfortunately you wont find one here. See IRS Publication 969. This campaign addresses tax noncompliance related to taxpayers failure to report income generated and information reporting associated with offshore banking accounts.

Mar 7 2022.

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace

You Didn T Check The Presidential Election Campaign Box On Your Taxes Did You It S All Politics Npr

Fundraising Planning Guide Calendar Worksheet Template Marketing Plan Template Fundraising Marketing Nonprofit Fundraising

Improve Your Accounting By Using Sku Numbers Small Business Trends Business Trends Small Business Trends Business Strategy

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

We Thank Each And Every One Of You Who Have Been A Part Of Our Contribution And Has Helped Make This Campaign A Success T You Better Work No Response Thankful